Wheda Income Limits 2025. In 2025, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above. Appendices provide instruction/information needed to prepare a housing tax credit (htc) application.

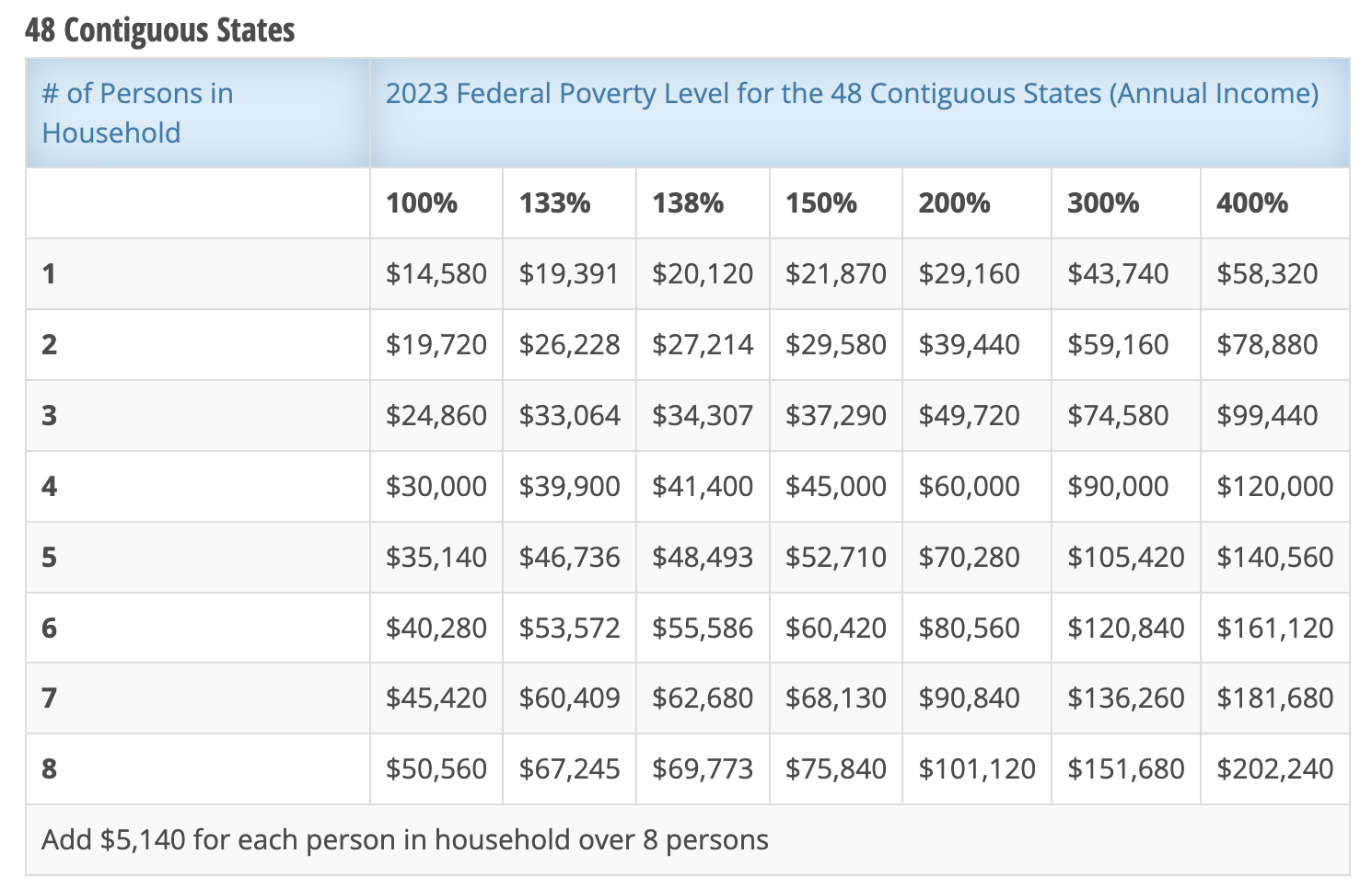

The affordable care act is the 2010 comprehensive health law known as “obamacare” or, simply, the. Income and rent limits including standard mtsp, hera special and average income and be found in the multifamily data library.

The application period for the highly competitive 2025 housing tax credit program runs from november 17, 2025, until january 26, 2025.

The mtsp income limits are used to determine qualification levels as well as set maximum rental rates for projects funded with tax credits authorized under section 42 of the.

20232024 Eligibility Guidelines CDPHE WIC, The application period for the highly competitive 2025 housing tax credit program runs from november 17, 2025, until january 26, 2025. This figure is up from the 2025 limit of $6,500.

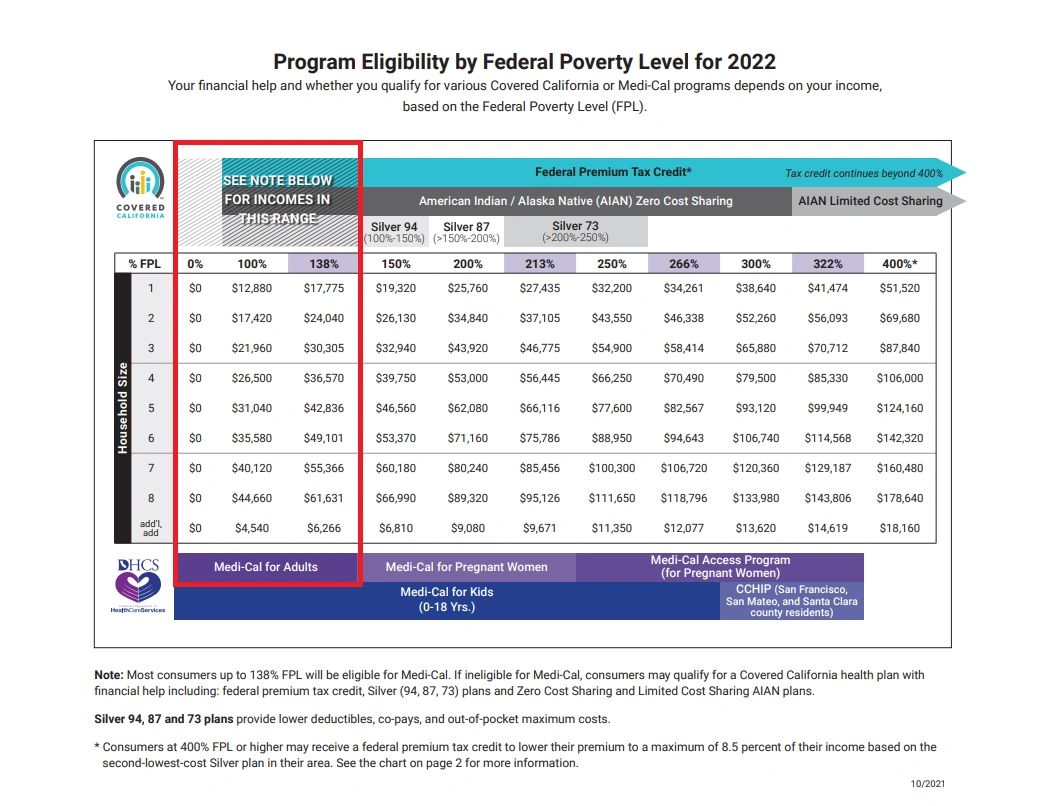

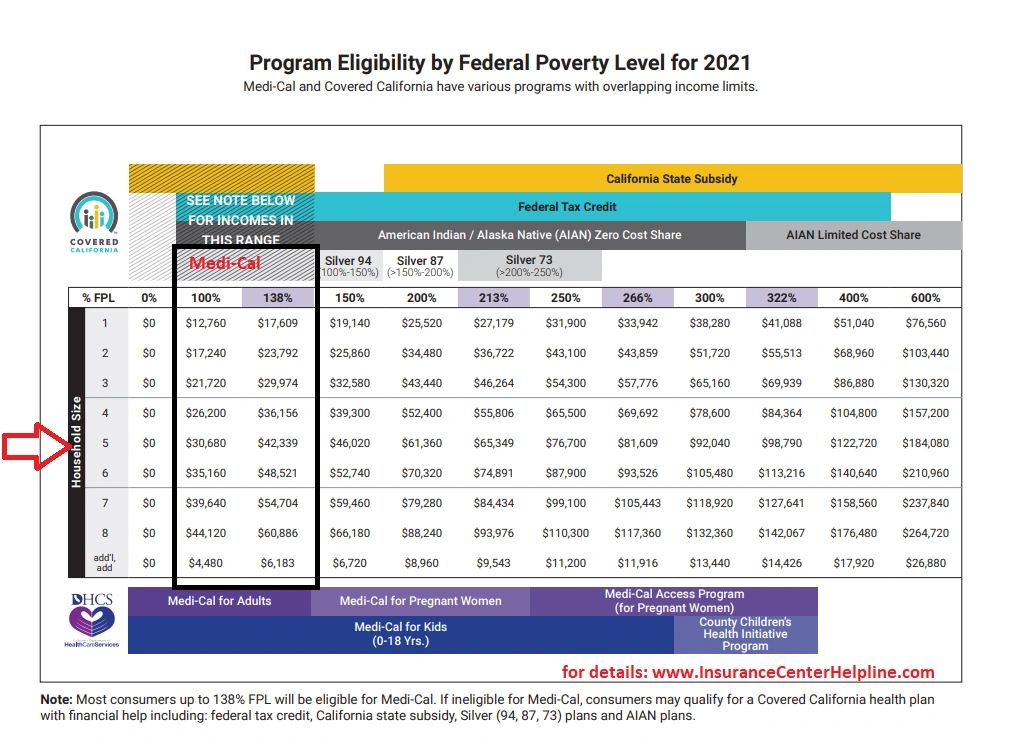

Updated Limits and Subsidy for Obamacare in 2025 Mira, Income and rent limits including standard mtsp, hera special and average income and be found in the multifamily data library. Share sensitive information only on official, secure websites.

Health Insurance Limits for 2025 to receive ACA premium s, Income and rent limits including standard mtsp, hera special and average income and be found in the multifamily data library. The affordable care act is the 2010 comprehensive health law known as “obamacare” or, simply, the.

IRA Contribution Limits in 2025 Meld Financial, Share sensitive information only on official, secure websites. The most recent reports are listed below.

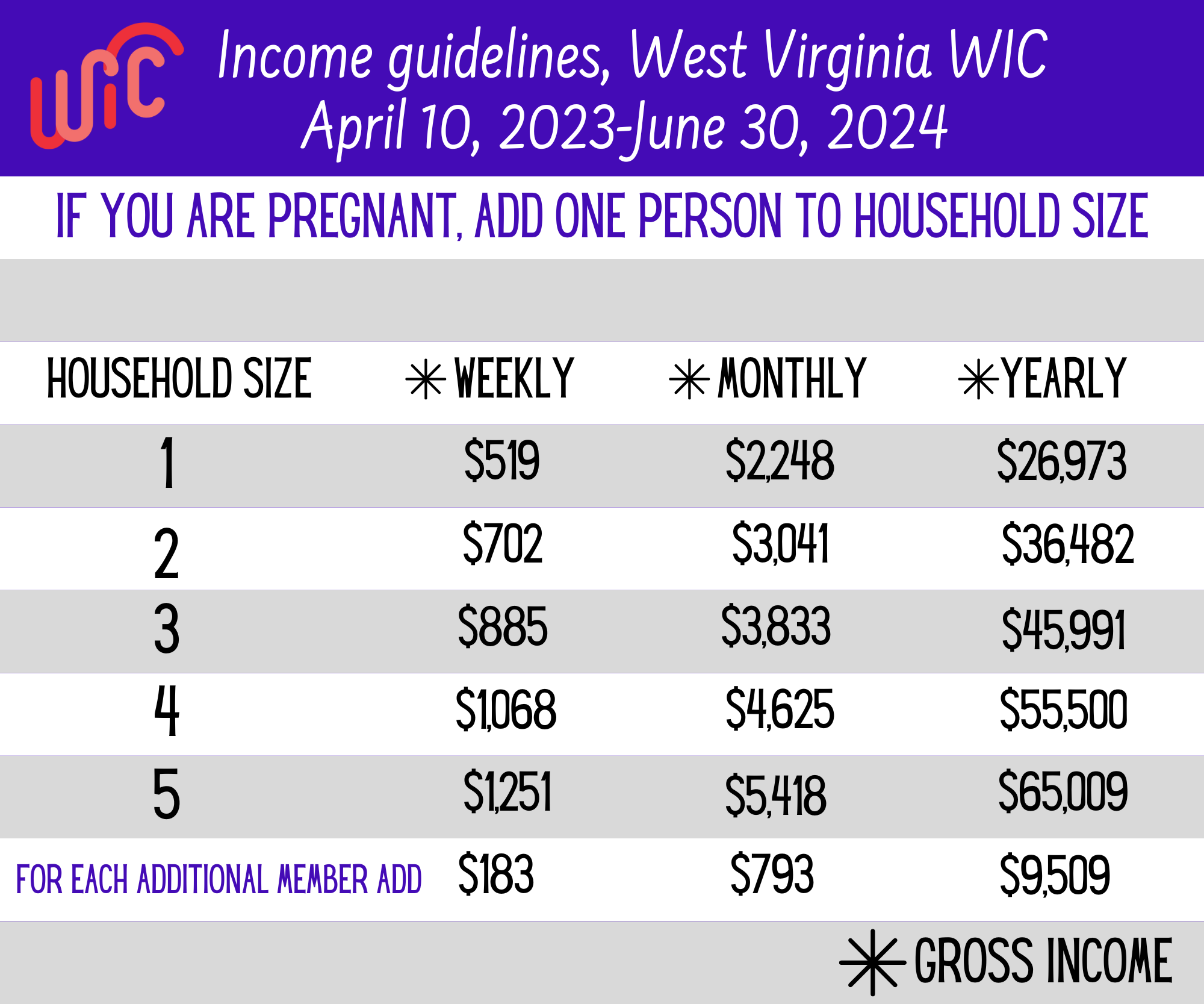

WIC Eligibility Guidelines Monongalia County Health Department, For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. For current rent limits for national.

What Are The Medicare Limits For 2025, Listed below are the scheduled deadlines for submitting lihtc applications and. To contribute to a roth ira, single.

New HSA/HDHP Limits for 2025 Miller Johnson, For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. Income and rent limits including standard mtsp, hera special, and average income can be found in the multifamily data library.

simple ira contribution limits 2025 Choosing Your Gold IRA, Share sensitive information only on official, secure websites. Contents [ show] the income tax slabs are different under the old and the new tax regimes.

Fsa 2025 Contribution Limits 2025 Calendar, * this includes a $20 general income exclusion. Share sensitive information only on official, secure websites.

USCIS Federal Poverty Guidelines for 2025 Immigration Updated, Income and rent limits including standard mtsp, hera special and average income and be found in the multifamily data library. And for 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older.