Income Tax Rates For Individuals Ay 2025-25. To understand the rates and tax calculation effectively, you must familiarise yourself with certain tax terminology. In the new income tax regime, the rebate eligibility threshold is set at rs 7,00,000, allowing taxpayers to claim a rebate.

This return is applicable for a resident (other than not ordinarily resident) individual having total income from any of the following. The deadline is for taxpayers, including.

This return is applicable for a resident (other than not ordinarily resident) individual having total income from any of the following.

Senior Citizen Slab Rate Ay 202425 Faun Rebecca, Resident senior citizen (who is 60 years or. Jun 16, 2025, 12:54:00 pm ist.

Tax rates for the 2025 year of assessment Just One Lap, To understand the rates and tax calculation effectively, you must familiarise yourself with certain tax terminology. Under the old tax regime, taxpayers can benefit from various exemptions and deductions.

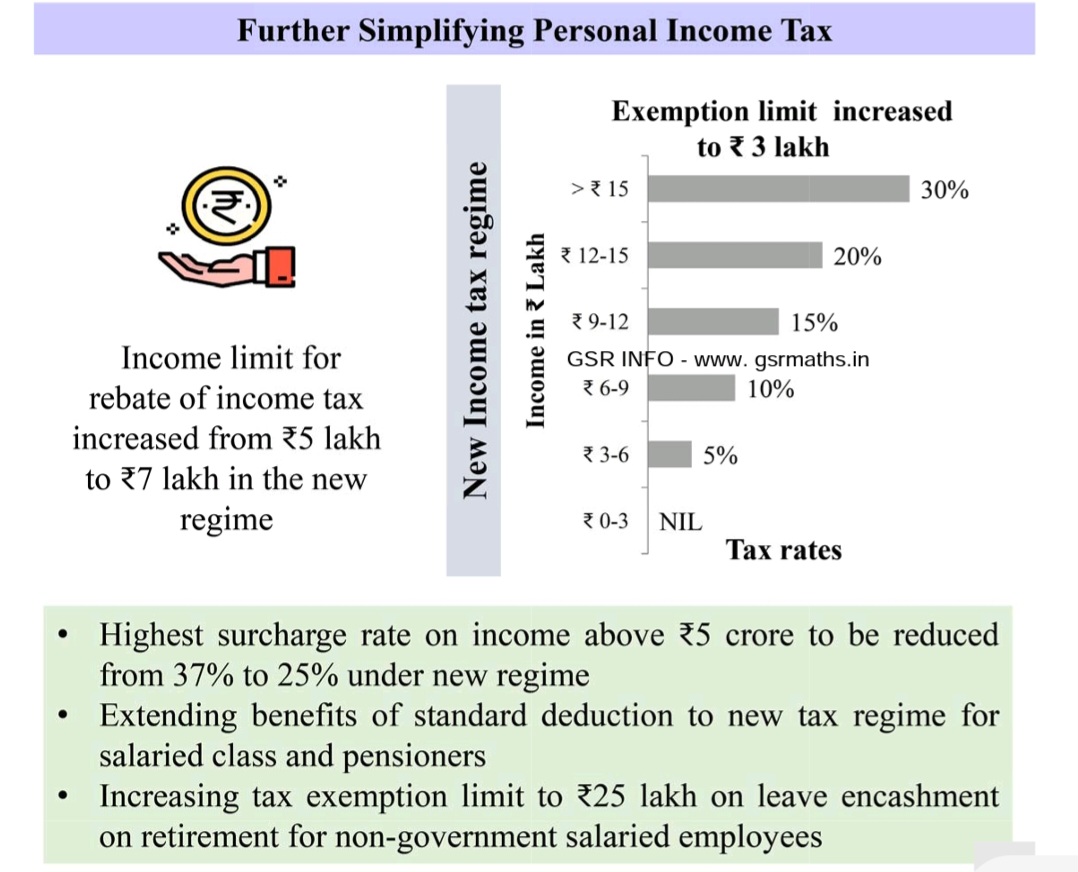

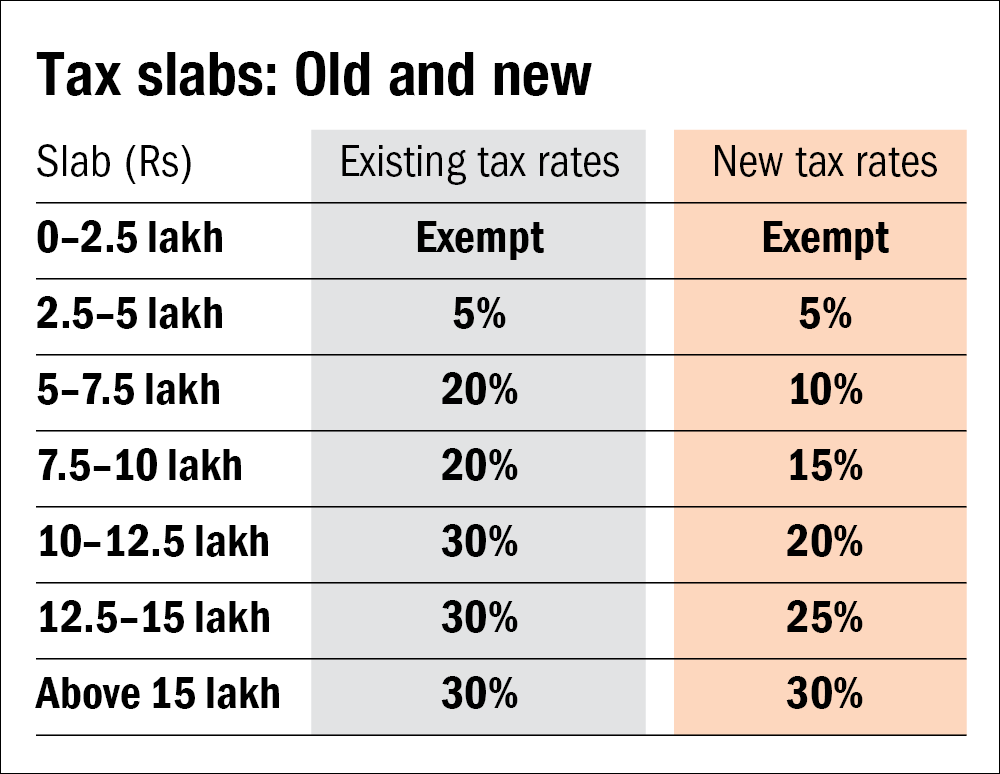

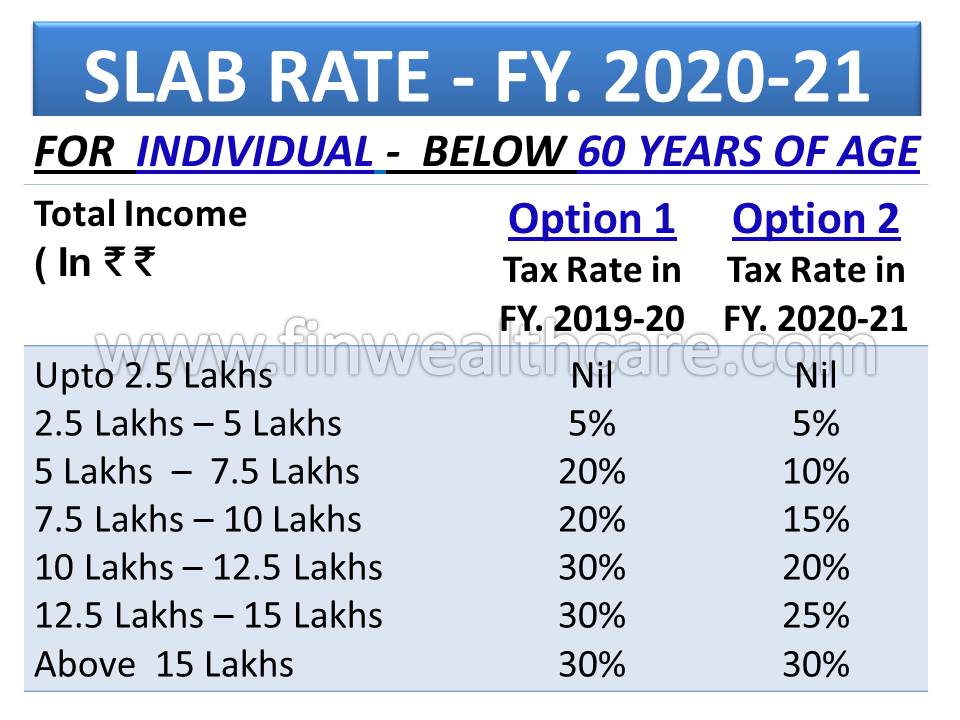

Tax Slabs FY 202324 and AY 202425 (New & Old Regime Tax Rates), Income tax slabs (rs) income tax rate (%) from 0 to 3,00,000: The new financial years starts from april 1.

2025 Federal Tax Brackets And Rates kenna almeria, The new financial years starts from april 1. This return is applicable for a resident (other than not ordinarily resident) individual having total income from any of the following.

Tax Slabs FY 202324 AY 202425 GSR INFO AP TS Employees, Discover the tax rates for both the new tax regime and the old tax regime. The new financial years starts from april 1.

SBI Mitra SIP A Powerful Tool To Get Monthly BestInvestIndia, To understand the rates and tax calculation effectively, you must familiarise yourself with certain tax terminology. Income tax slabs for itr.

New Tax Regime Slab Rate For Ay 202425 Uefa Taryn Francyne, Income tax slabs for itr. To understand the rates and tax calculation effectively, you must familiarise yourself with certain tax terminology.

New Tax Slab Rate 2025 In Budget 2025 For Fy 2025 24 Ay 2025 25, Under the old tax regime, taxpayers can benefit from various exemptions and deductions. It is important to know the correct income tax.

![Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/w1200-h630-p-k-no-nu/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png)

Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax, The new financial years starts from april 1. , et online last updated:

Tax Slabs for Individuals in FY 202324 & AY 202425 AnpTaxCorp, The deadline is for taxpayers, including. It is important to know the correct income tax.

An income tax calculator is an online tool that helps individuals calculate the amount of income tax they will owe to the government based on their taxable income.

In the new income tax regime, the rebate eligibility threshold is set at rs 7,00,000, allowing taxpayers to claim a rebate.